Capital Markets Day 2017 CFO Speech Slide 2 – One Bank, One UniCredit / The five pillars Thank you TJ, and good morning everyo

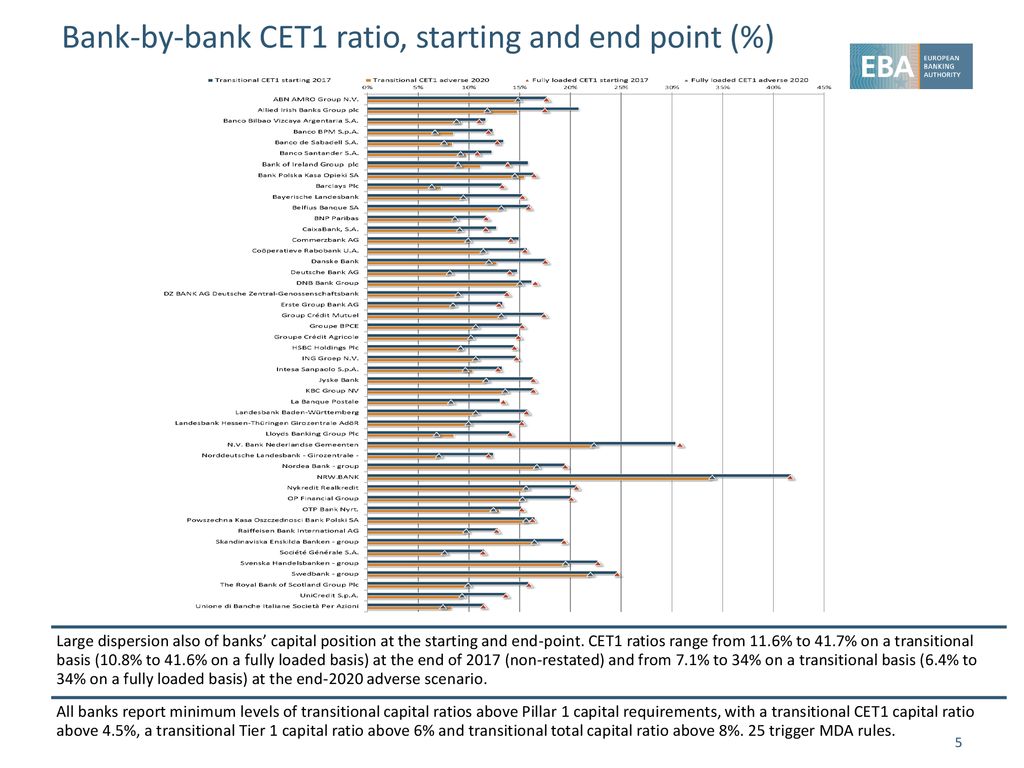

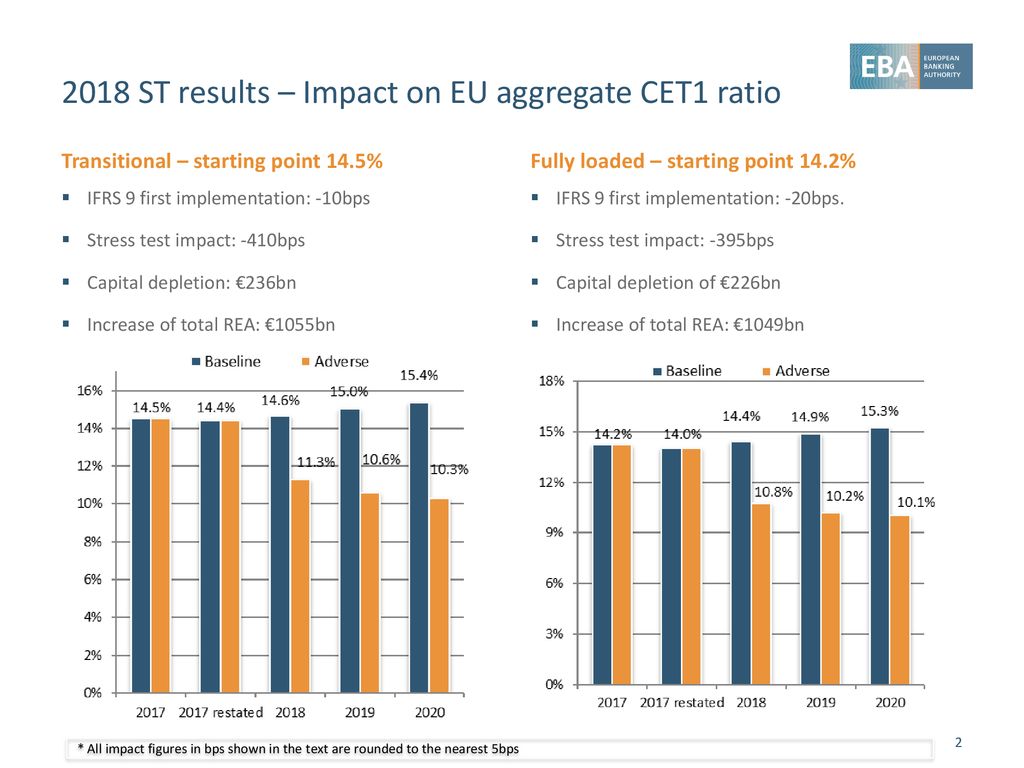

EBA publishes the results of its 2021 EU-wide stress test | EBA publishes the results of its 2021 EU-wide stress test | Better Regulation

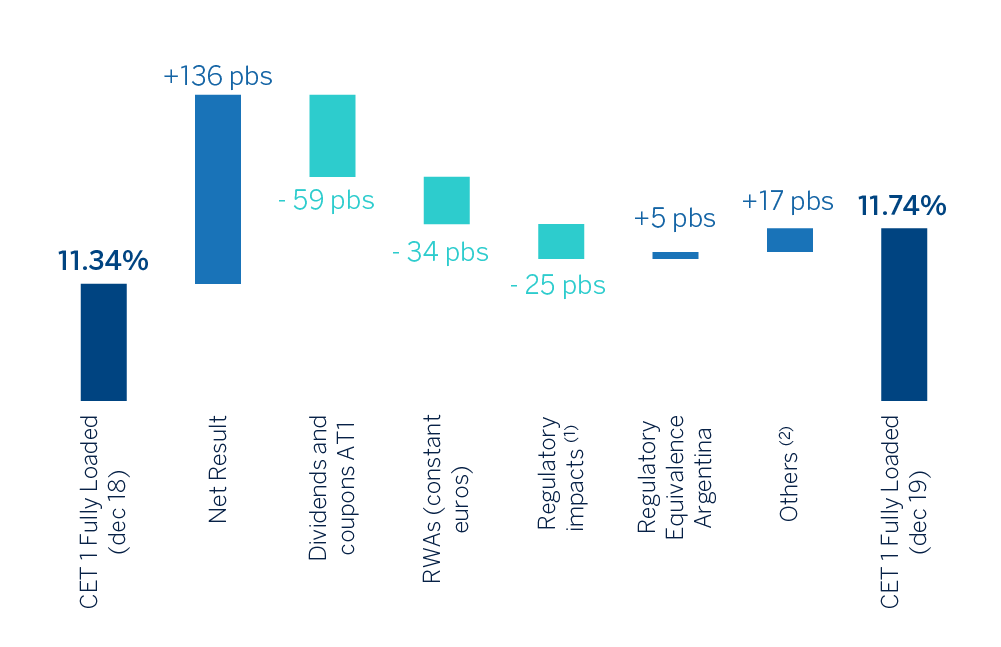

Banco Santander: A 5.5B EUR Capital Deficit In The Stress Test Adverse Scenario Isn't A Big Issue (NYSE:SAN) | Seeking Alpha

la Caixa Group passes the ECB Comprehensive Assessment with a CET1 ratio of 9.3% under the adverse scenario, while CaixaBank would achieve 10.3%

Capital strength: the common equity tier 1 fully loaded ratio stood at 11.4% at 2015 year-end. A capital increase of €1,607